What is a public adjuster and what are the pros and cons of hiring one? This Ultimate Homeowners Guide will answer all the important questions about public insurance adjusters, and help you consider whether or not to hire one.

Jump to section:

- Understanding the Basics

- Public Adjuster vs Insurance Adjuster: What’s the Difference?

- Pros of Hiring a Public Adjuster

- Cons of Hiring a Public Adjuster

- Conclusion

Understanding the Basics

If you’re a homeowner with home insurance who’s dealing with serious damage or catastrophic loss to your home, then you need to call your insurance provider to file an insurance claim.

This is generally one of the first steps to take if your home experiences the following types of property damage:

- Collapse, decay, or vibration

- Explosion

- Fire and smoke damage

- Flood and water damage

- Frozen pipes

- Hail damage

- Hurricane and wind damage

- Lightning

- Mold

- Plumbing leaks

- Roof damage

- Sinkholes

- Tornado damage

- Winter storms

Once you call the insurance company about the property damage, they’ll send their adjuster to evaluate the damage and file a claim. Once this process is complete and they’ve reviewed the claim, you’ll receive an insurance settlement.

But what if you think the payout isn’t fair, or you feel there’s been a miscalculation? Is there anything else you can do?

Most people are unaware that you can hire an independent public adjuster to help you file or revise a claim. A public adjuster can help you get a payout that accurately reflects the damage based on your policy’s coverage.

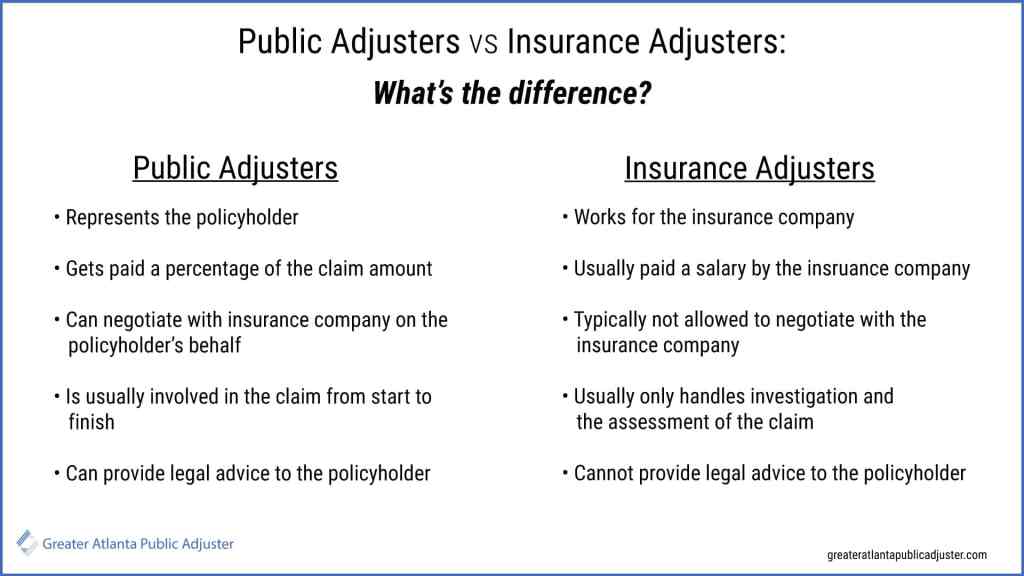

Public Adjuster vs Insurance Adjuster: What’s the Difference?

Public Adjusters

A Public Adjuster is an independent claims adjuster who represents the interests of policyholders in negotiating a fair settlement with an insurance company.

They’re paid a fee by the policyholder and are not employed by the insurance company. Public Adjusters are often hired to handle complex or large losses due to disasters, such as fires, floods, or hurricanes.

Insurance Adjusters

An Insurance Adjuster is an employee of the insurance company who investigates and evaluates insurance claims on behalf of the insurance company.

They assess the damage, estimate the cost of repair, and work with the policyholder and the insurance company to reach a settlement. Insurance adjusters are typically paid a salary by the insurance company.

In 2023, insurance companies are frequently hiring contractors known as “independent adjusters” to perform on site inspections. Independent adjusters are not the same as public adjusters, as these individuals are still working on behalf of the insurance companies.

Summary of differences

In a nutshell, a public adjuster:

- Represents the policyholder

- Gets paid a percentage of the claim amount

- Can negotiate with the insurance company the policyholder’s behalf

- Is usually involved in the claim from start to finish

- Can provide legal advice to the policyholder

On the other hand, an insurance adjuster:

- Works for the insurance company

- Gets paid a salary by the insurance company if they’re an employee, or is paid one a case by case basis if they’re a contractor (“Independent Adjuster”)

- Is typically not allowed to negotiate with the insurance company

- Usually only handles the investigation and assessment of the claim

- Cannot provide legal advice to the policyholder

Pros of Hiring a Public Adjuster

Objectivity

When an insurance adjuster performs an on site inspection of your property damage, they are representing the insurance company.

In addition, insurance adjusters have an overload of cases and it’s not in their interest to spend significant time accounting for every item you may have lost.

Therefore, people are often surprised and disappointed when their insurance claim settlement is thousands of dollars off from what they are rightfully owed. Other times, insurance companies might deny your claim all together.

This is one of the main reasons why people hire a public adjuster. Public adjusters can provide an objective evaluation of your insurance claim, which may be beneficial if your insurance company is denying your claim.

Insurance adjusters are viewing the property damage or loss in a more subjective way because it’s their job to do so.

On the other hand, public adjusters can evaluate the total loss and damage of your property on a case by case basis to make sure that you’re receiving fair compensation on your claim.

Simplify the process

If you’ve ever tried to file an insurance claim on your own, you know that all of the paperwork and red tape can be daunting. From the insurance company’s perspective, the more complicated the process is, the better!

Insurance companies know that you’re undergoing a situation that’s stressful both emotionally and financially.

For the average person, navigating the claims process is difficult and complicated. As a result, these companies know that most people are willing to just accept the claim based solely on their calculations.

But is it possible to receive fair compensation on your insurance claim without having to deal with all of the paperwork yourself?

The answer is yes! Hiring a public adjuster can help you navigate the complicated process of filing an insurance claim and ensure that all required paperwork is filed correctly.

Negotiate with the insurance company

Filing claims paperwork is only one step of the process. Ultimately, the claims and settlement decisions are still made by people.

There can be several people assigned to a case at any time. As a result you need a public adjuster who can be a liaison to advocate and negotiate with the insurance company on your behalf.

To learn more about negotiation and strategy, call Scott Beitbarth today.

Can help you maximize the claim settlement value

Because insurance adjusters have a large caseload and are employed by the insurance company, things are often overlooked during the inspection and claims process. This can lead to claim settlements that are undervalued.

A public adjuster can help you maximize the value of your claim, which can result in a higher settlement amount. This is especially true if you feel that there’s things that need fixing you can’t see on the surface. Public adjusters can make sure nothing is missed in the claim and claim settlement.

Strict professional standards

Some people are of the opinion that public adjusters are crooks, but this couldn’t be further from the truth. In fact, public adjusters must follow strict legal requirements, have extensive knowledge, and maintain professional standards.

Specifically, a public adjuster must be:

- Bonded

- Licensed in the states they wish to work

- Fingerprinted

- Able to pass a background check

Most states have strict standards and training programs for public adjusters. In Georgia, they must pass a licensing exam.

Many public adjusters are also members of the National Association of Public Insurance Adjusters (NAPIA).

Moreover, a public adjuster must have a thorough understanding of the claims process for both residential and commercial properties.

When a severe natural disaster occurs or a home or commercial property suffers catastrophic loss, it’s important for the homeowner or business owner to find someone they can trust to advocate on their behalf. Fortunately, you can rest assured that states have high standards in place to qualify public adjusters.

Cons of Hiring a Public Adjuster

Return not a guarantee

If you’re considering hiring a public adjuster, it’s important to find one you can trust to give you an honest evaluation of whether or not you can get a higher claim settlement than what the insurance company offered.

After all, you don’t want is to go through all of the hassle of submitting a new claim only to be denied.

You should also be sure to understand how your public adjuster’s compensation structure works. A public adjuster might be able to get you a bigger settlement, but after they collect their fees will this still be more than what the insurance company offers you?

Each case is different, which is why Scott Breitbarth offers a free inspection and policy review. He only gets paid if there’s a settlement, so if you have questions about getting a return on your investment, contact him today.

Can take a long time to settle

If you’ve been through the claims process for a catastrophic event before, then you know it’s not exactly a swift process. This is especially true when FEMA gets involved, and the initial claim can take a minimum of 90 days.

There’s many people involved in the claims process. Furthermore, in the event of a widespread storm like a hurricane, insurance companies get overwhelmed with claims to sift through.

When these catastrophic events occur, hiring a public adjuster can sometimes make the process take even longer. Some people simply can’t afford to wait for a better settlement, and as a result they’re willing to just take whatever the insurance company offers.

However, if you’re able to get a reliable public adjuster involved early in the process, they can help you every step of the way.

Many public adjusters only work on major claims

Most public adjusters are paid on a compensation basis. Therefore, they typically prefer to take on larger cases that will result in a larger settlement for their clients and for themselves.

However, this is not the case for U.S. Public Adjuster Scott Breitbarth. In fact, sometimes Scott prefers to take on simpler cases with a fast turnaround time rather than catastrophic property damage or loss.

Lack depth of experience

In some situations, a public adjuster may not have the same level of knowledge or experience as an insurance adjuster who works for the insurance company. If the public adjuster isn’t familiar with insurance policies, how to conduct an inspection, or how to properly file paperwork, these can all be red flags.

Fortunately, this is not the case with Scott Breitbarth. Scott understands the perspective of both the homeowner and the insurance company. He takes extreme care during the inspection, and carefully files the paperwork in a prompt and accurate manner.

When you hire a public adjuster, make sure that they’re licensed and bonded. But beyond that, also make sure they have years of experience under their belt.

No guarantee they can negotiate

Part of the reason you want to make sure that the public adjuster you hire has years of experience under their belt is because you want to ensure that they have connections, know-how, and good negotiation skills.

A public adjuster may not be able to negotiate a higher settlement amount than what is offered by your insurance company. An ethical public adjuster like Scott Breitbarth will be upfront and honest about your situation, and the likelihood that he’ll be able to negotiate on your behalf.

Conclusion

By now you have a deeper understanding of what a public adjuster is, and the pros and cons of hiring one.

If your property is suffering from severe damage or catastrophic loss and you can afford the extra time it takes to work with a public adjuster, you’ll most likely receive a much bigger settlement. Generally speaking, the pros of hiring a public adjuster far outweigh the cons!

Just like every case is unique, every public adjuster is also unique. If you’re looking for a public adjuster in Georgia or Florida who’s professional, knowledgeable, and easy to work with, then call Scott Breitbarth today.